Saudi Arabia, the Arab region's largest economy, has been affected during the Covid-19 pandemic - but not to the extent of many parts of the world.

The year 2020 was marked by challenging business conditions as companies grappled with global movement restrictions and, particularly important for the kingdom, plunging oil prices.

However, 2021 has brought renewed optimism, with vaccines being rolled out across the Middle East, including in Saudi which has been inoculating residents since January.

Hiring and pay rises

A study by HR and recruitment specialist Cooper Fitch at the end of last year found that more than three-quarters (79 per cent) of the 200 businesses polled in the Kingdom made no redundancies during 2020.

This was "a phenomenally high percentage given the macroeconomic context, and perhaps an indicator of the value that Saudi firms place on human capital", the report said.

On the salary front, more than 60 per cent had not revised salary ranges for existing employees for 2021.

"Our data shows that there are as many firms opting to reduce salaries amid a challenging context, as there are those needing to increase salaries based on their demand for talent," the Cooper Fitch report stated.

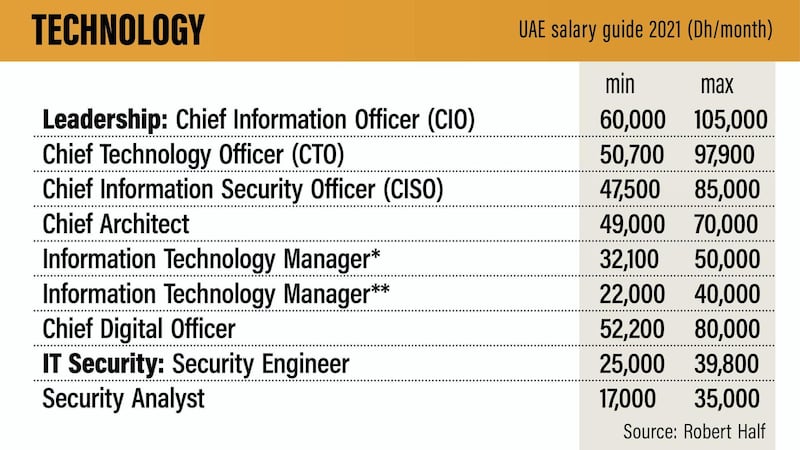

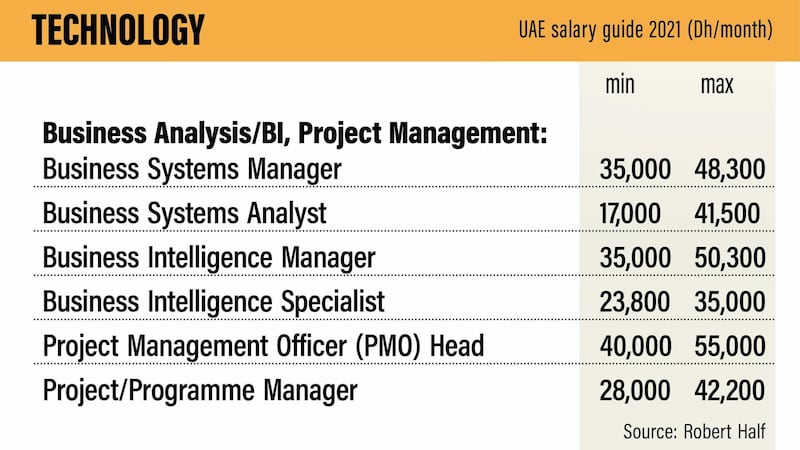

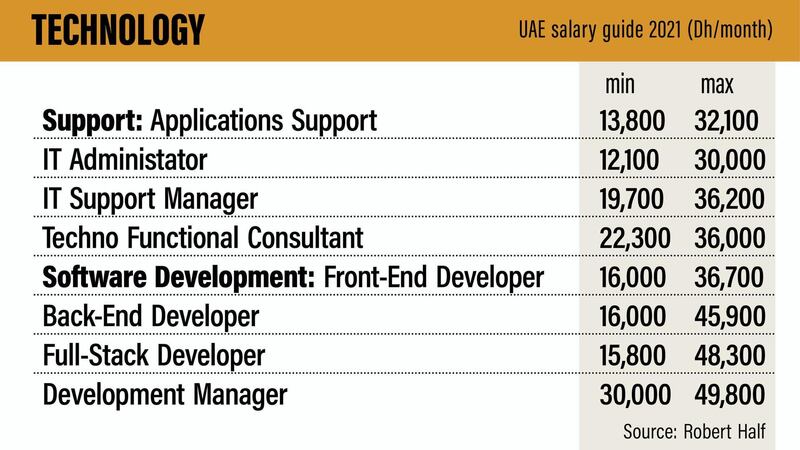

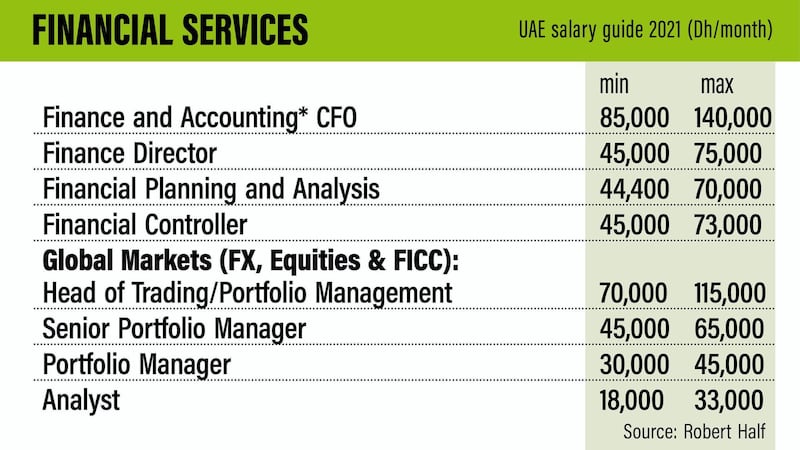

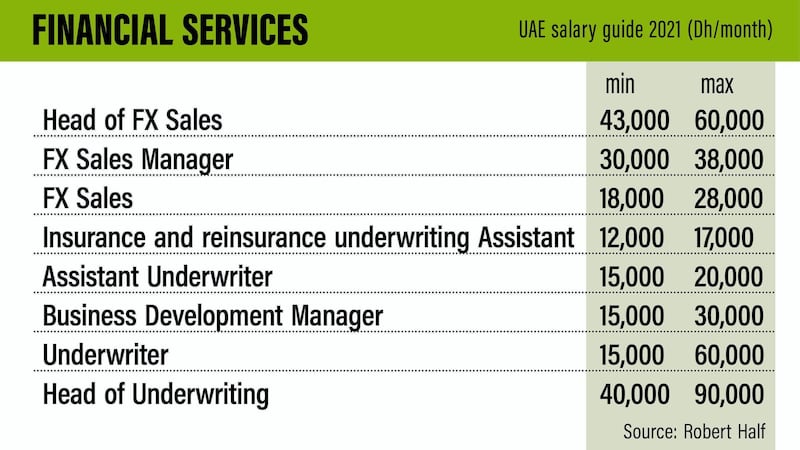

Technology, advisory and financial services sectors performed the strongest in terms of respondents indicating that they would implement a merit pay rise for staff in 2021.

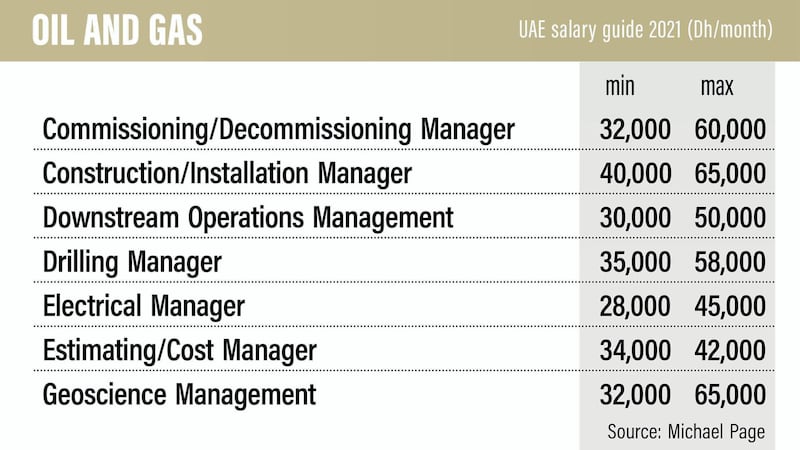

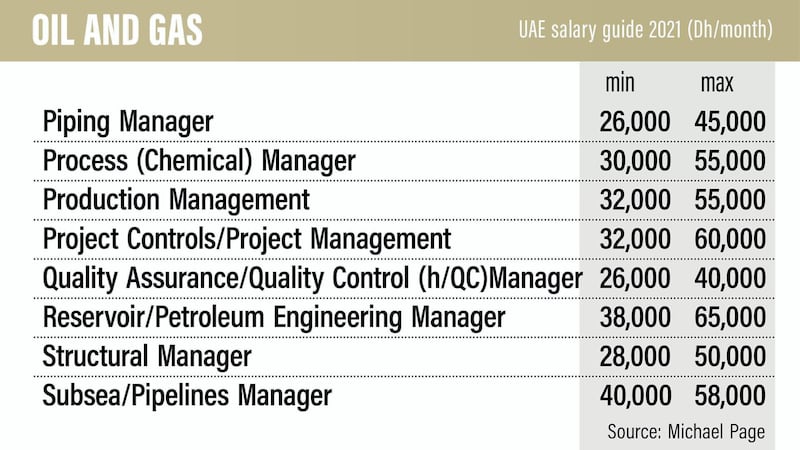

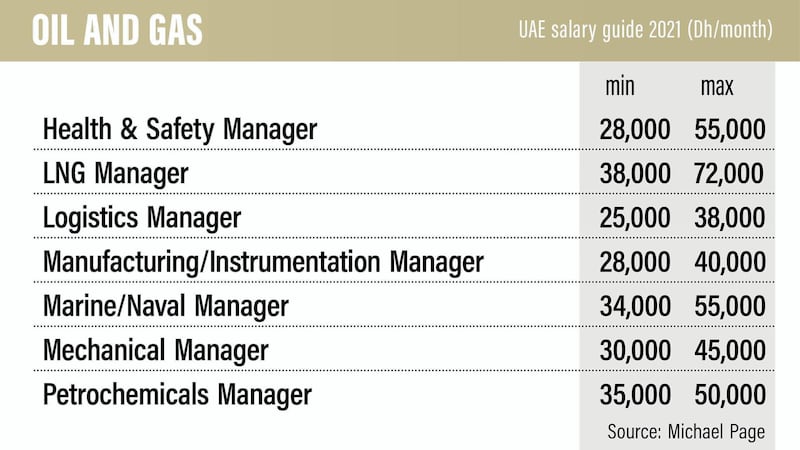

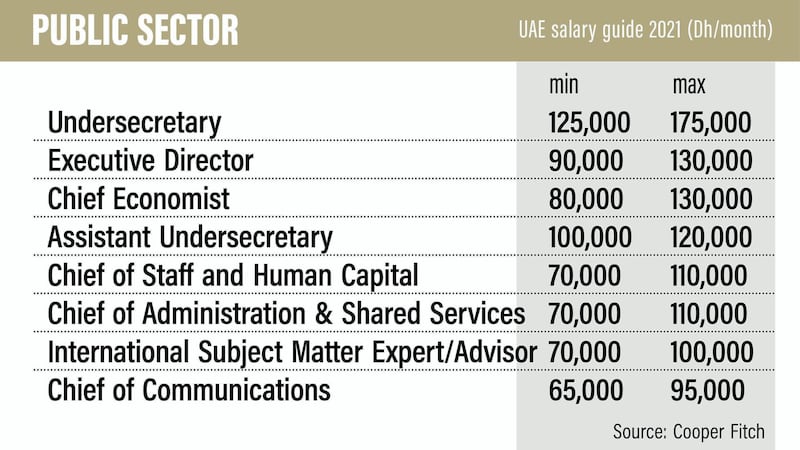

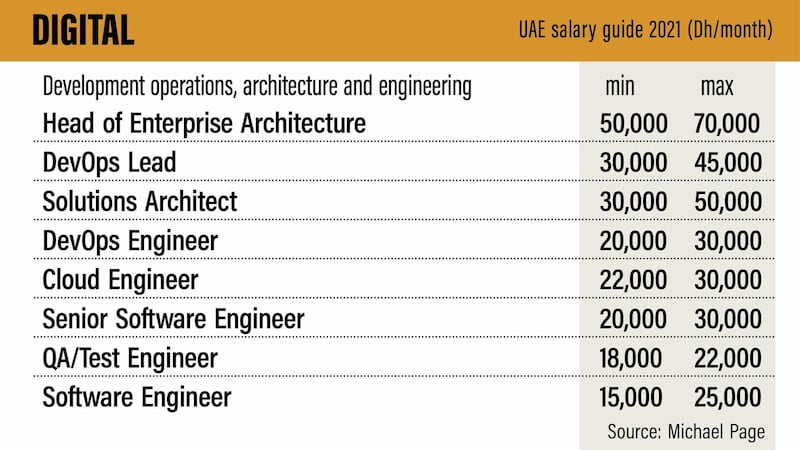

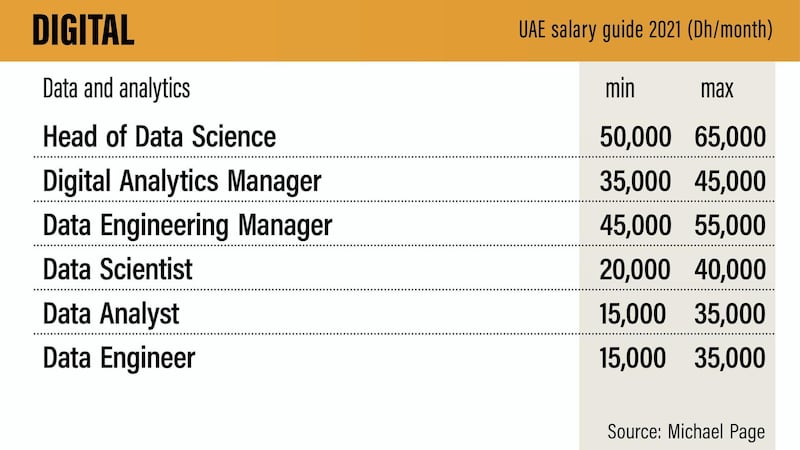

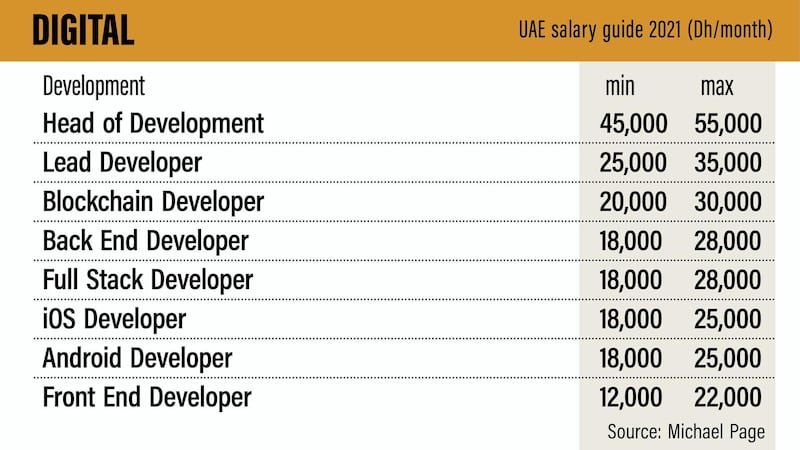

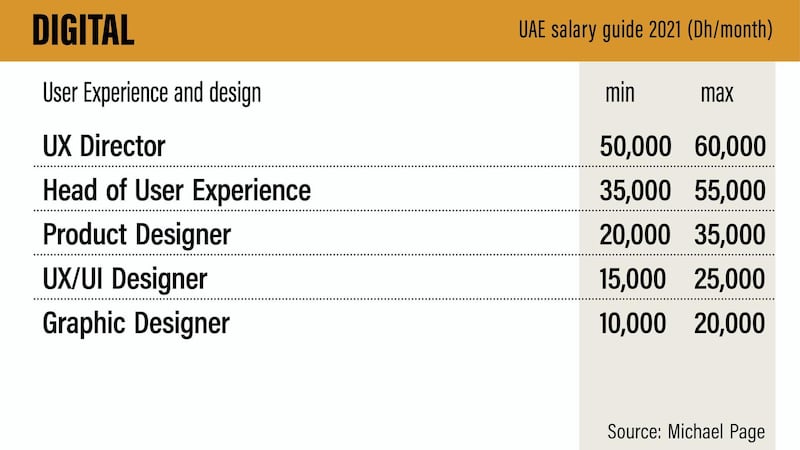

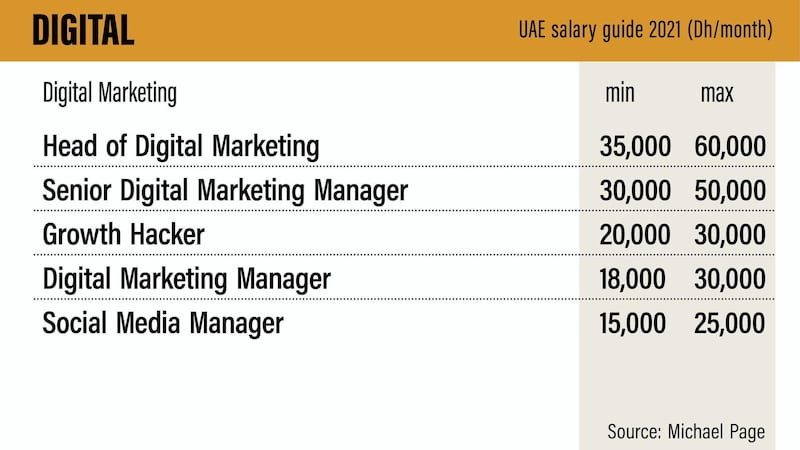

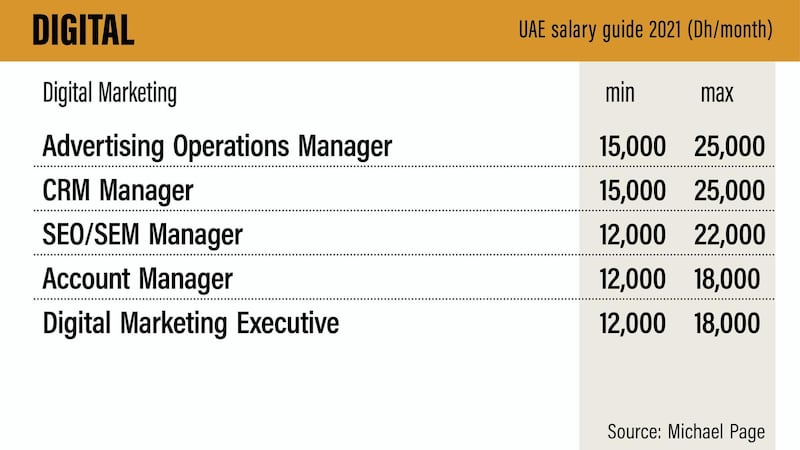

See the full salary list in the slideshow at the top of the page.

Highest paying jobs in Saudi Arabia in key sectors

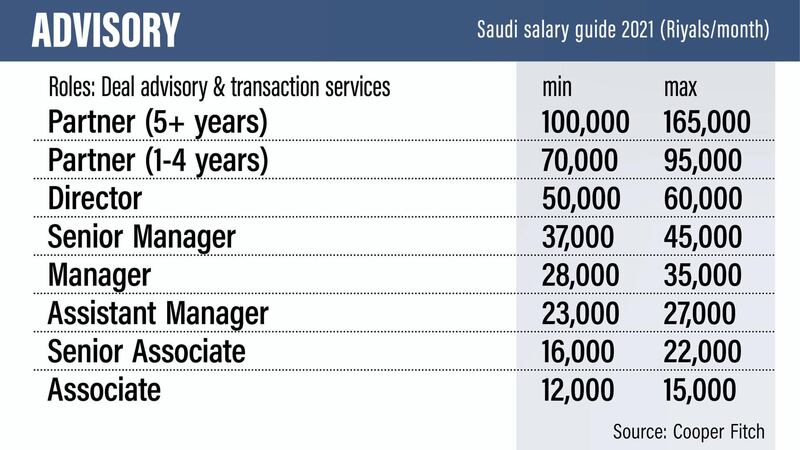

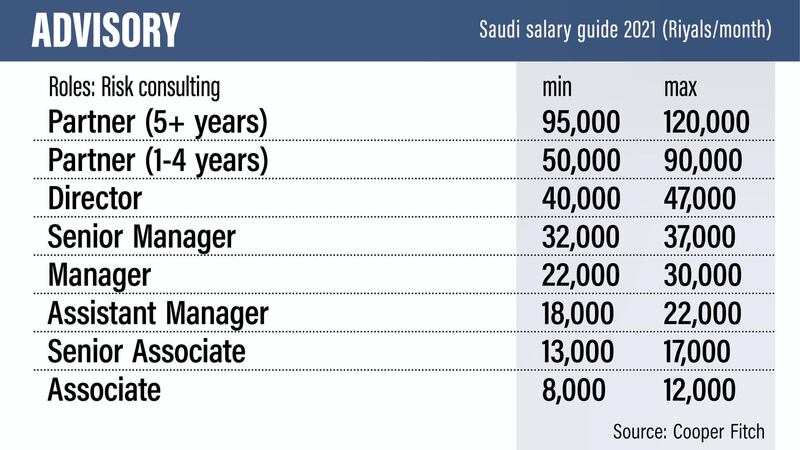

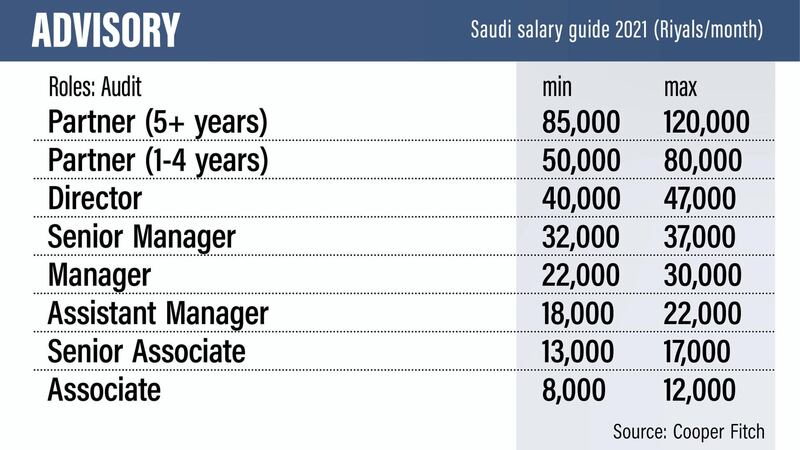

Advisory

- Deal and transaction services: 100,000-165,000 (riyals per month)

- Risk consulting: 95,000-150,000

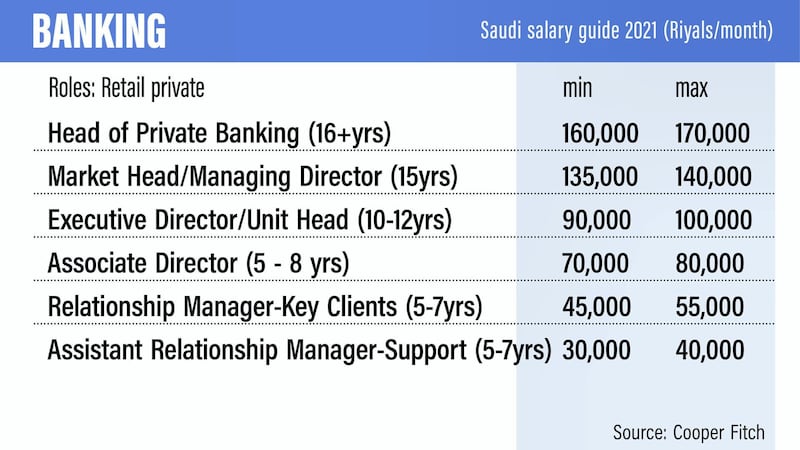

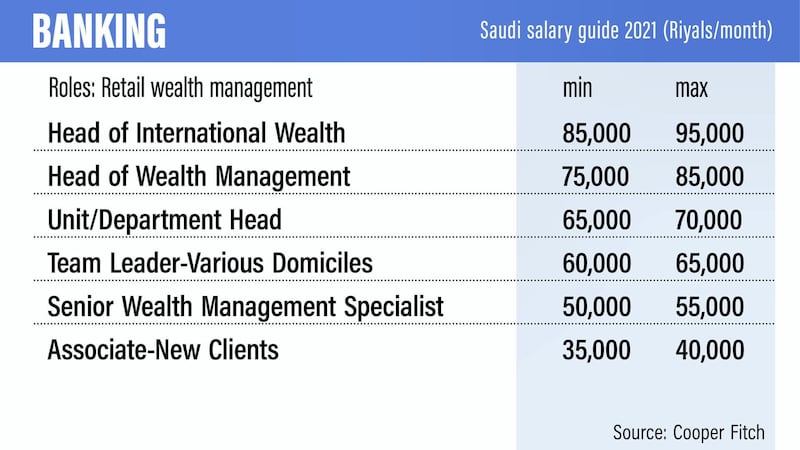

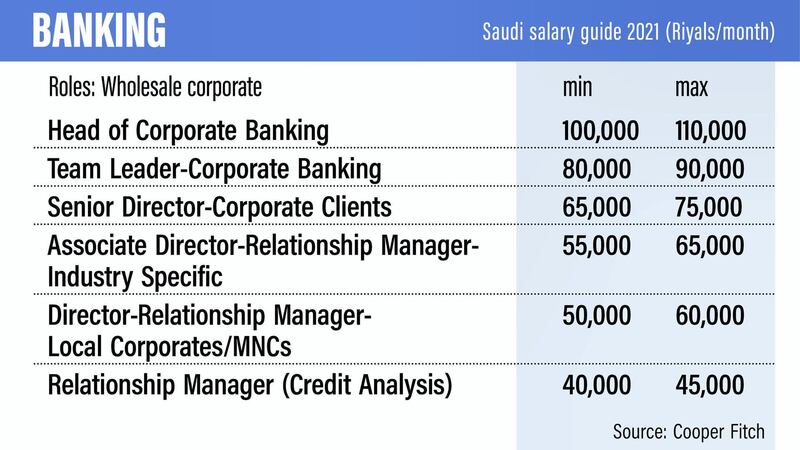

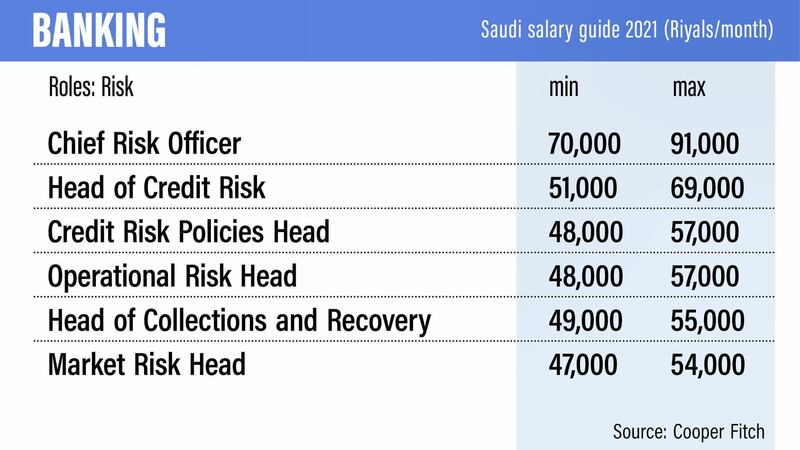

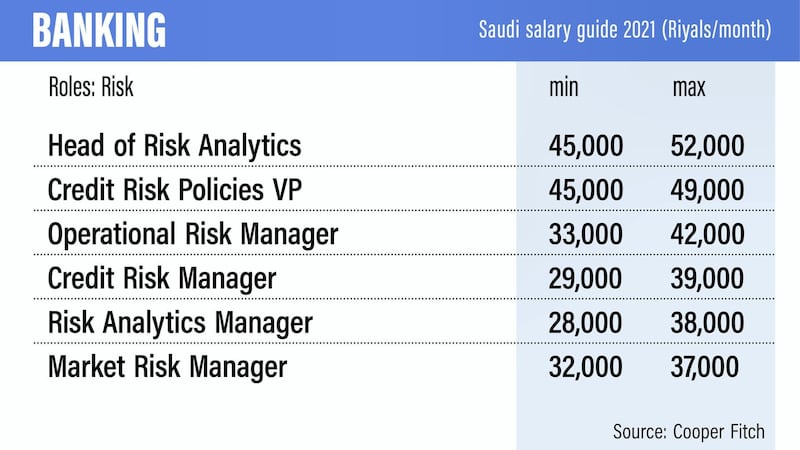

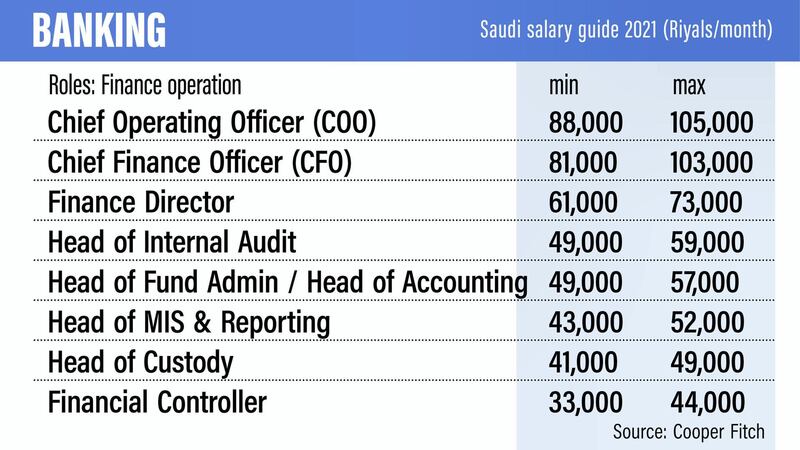

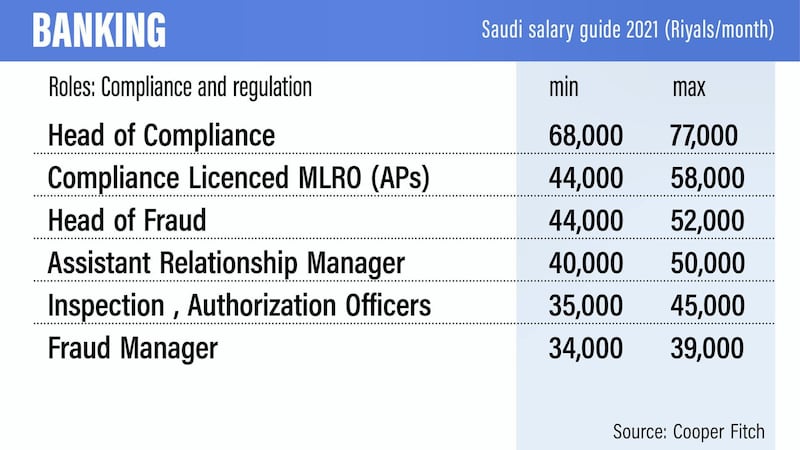

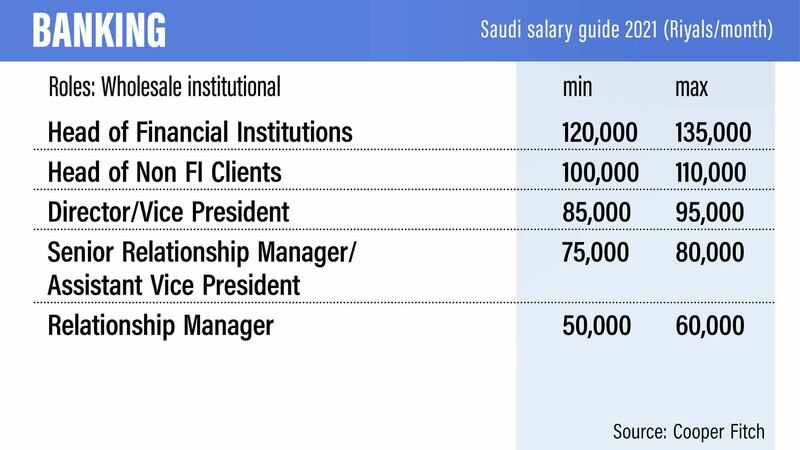

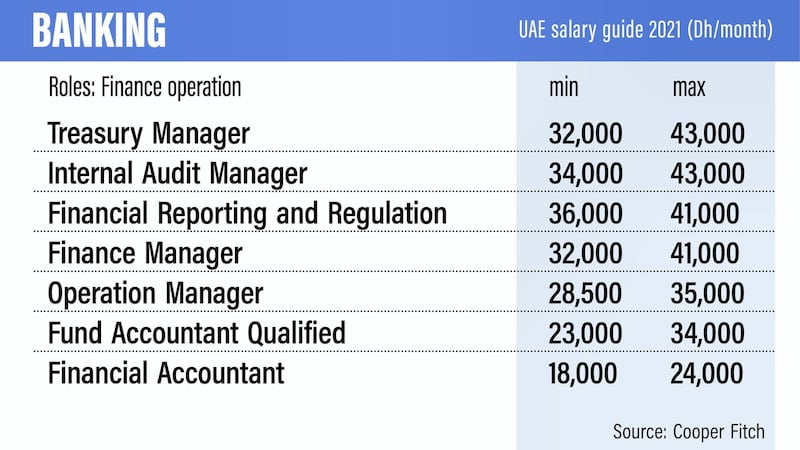

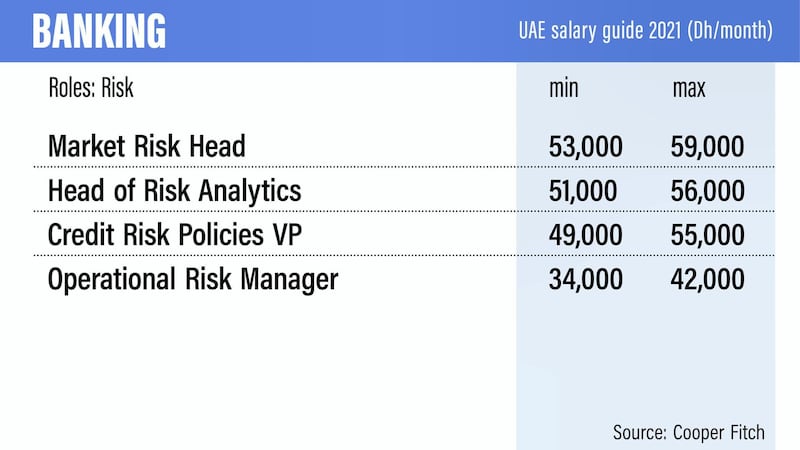

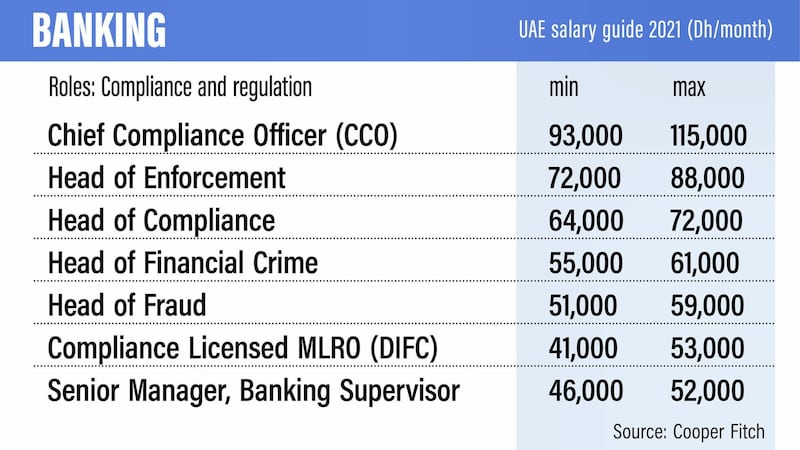

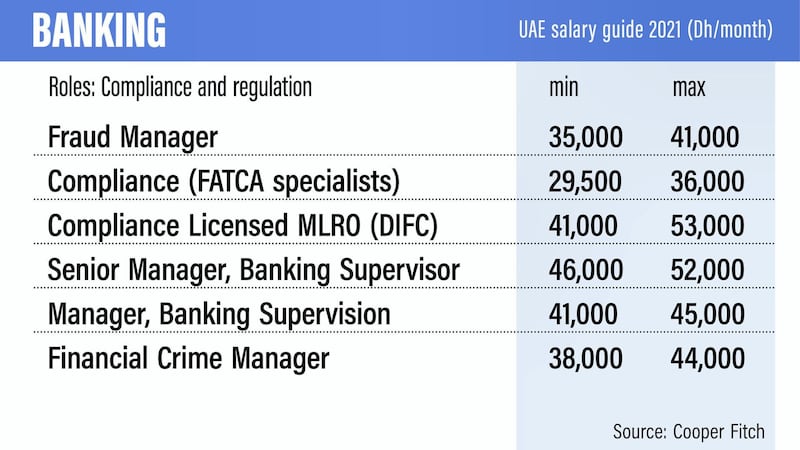

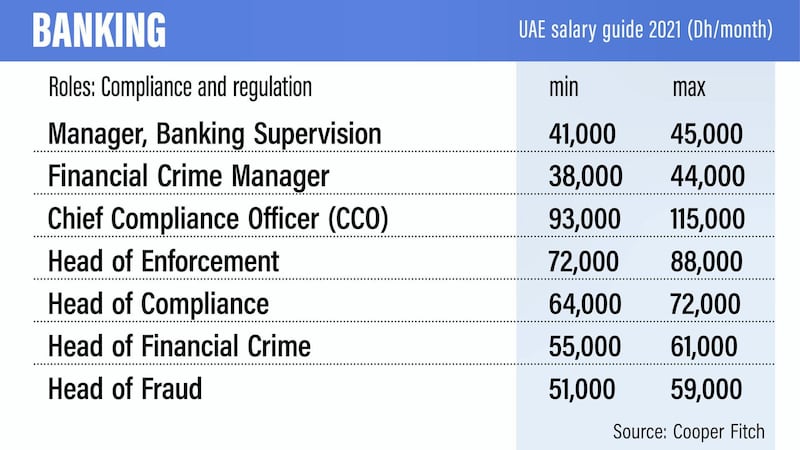

Banking

- Head of private banking (retail): 160,000-170,000

- Head of financial institutions (wholesale institutional): 120,000-135,000

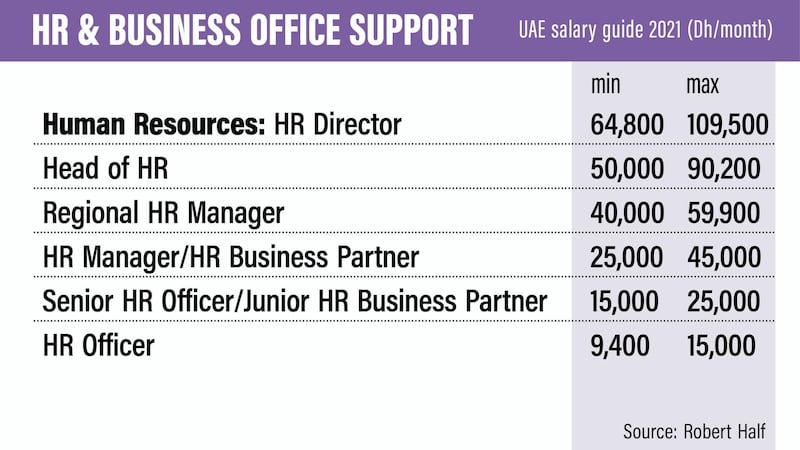

Human Resources

- CHRO: 100,000-155,000

- HR VP: 80,000-125,000

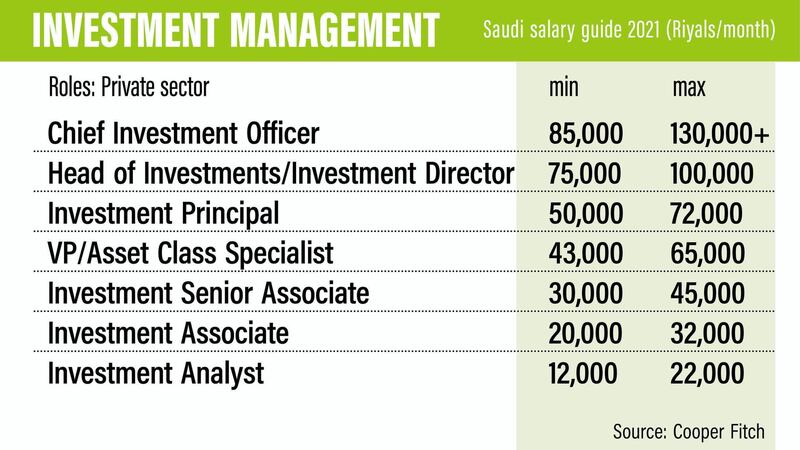

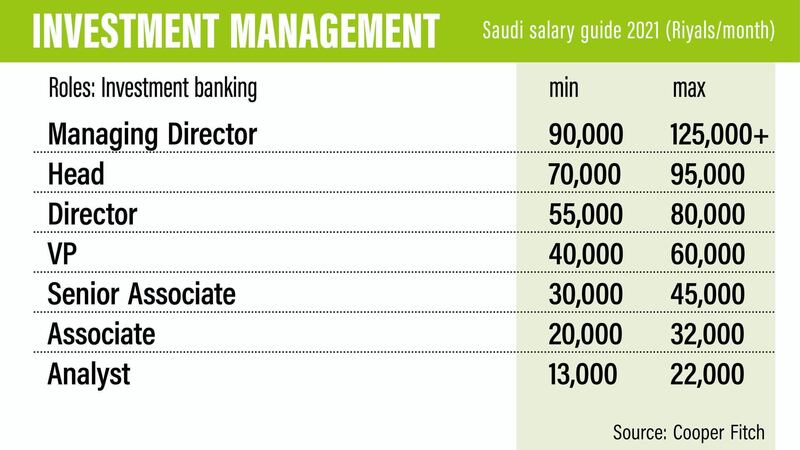

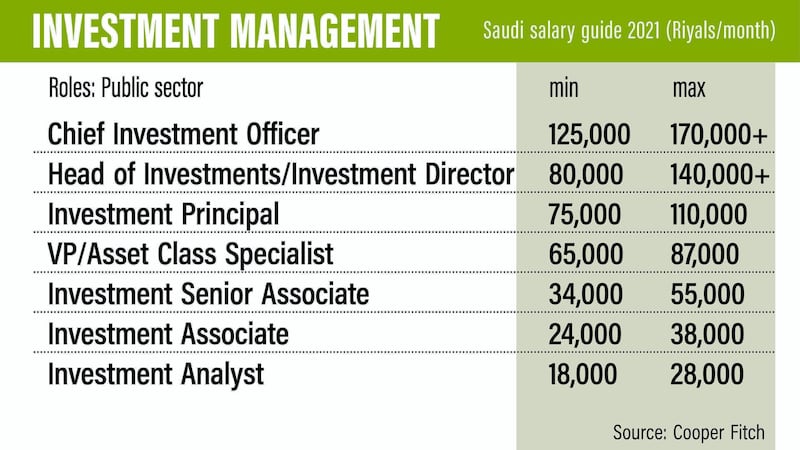

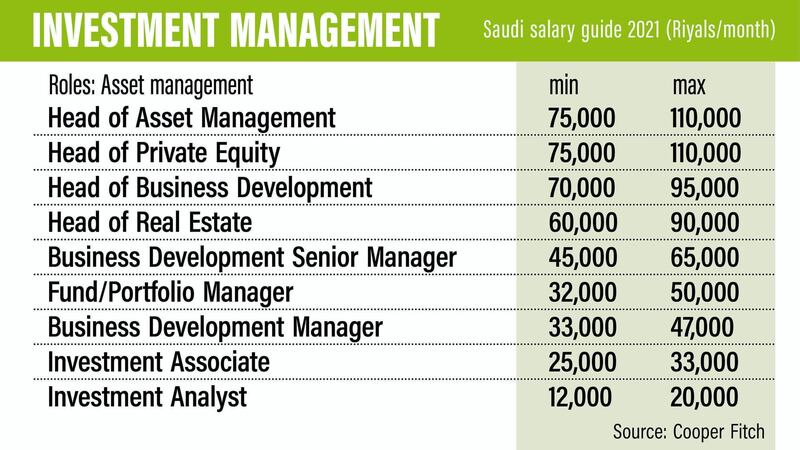

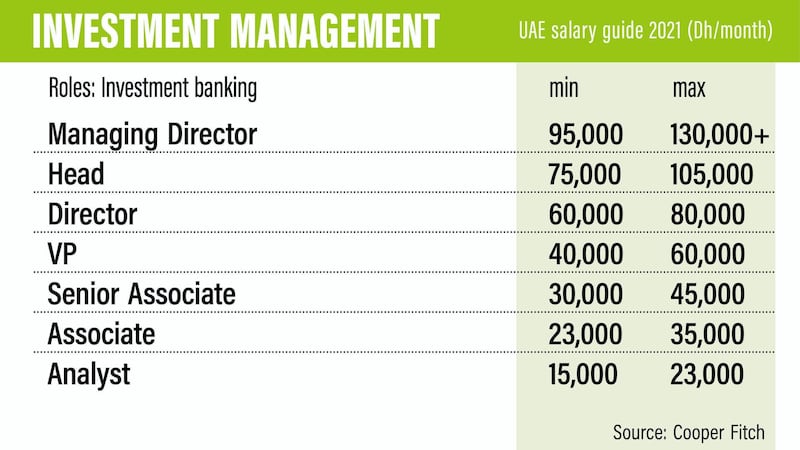

Investment management

- Chief investment officer (public sector): 125,000-170,000

- Managing director (investment banking): 90,000-125,000

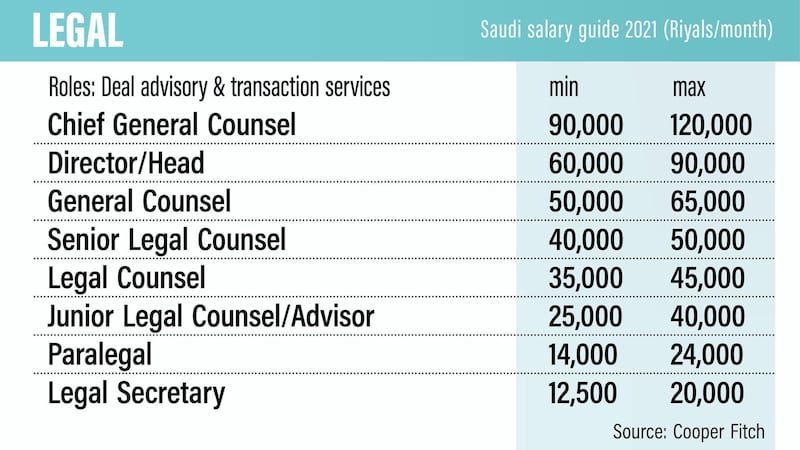

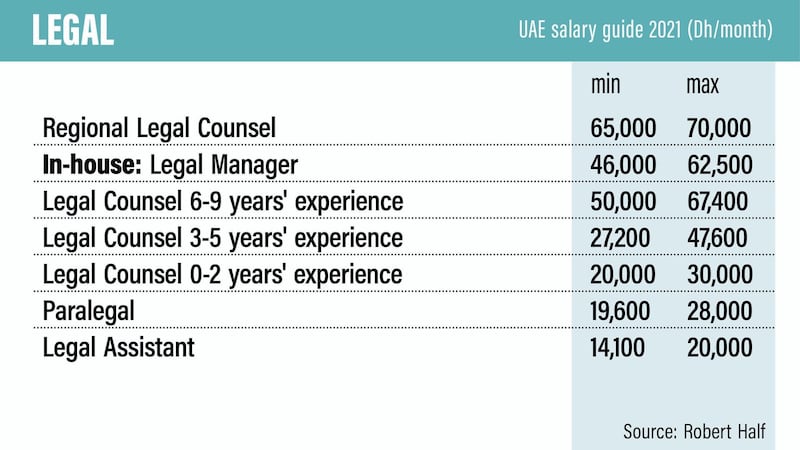

Legal

- Partner 5+ (private practice US & UK firms): 115,000-200,000

- Partner 5+ (private practice regional firms): 100,000-150,000

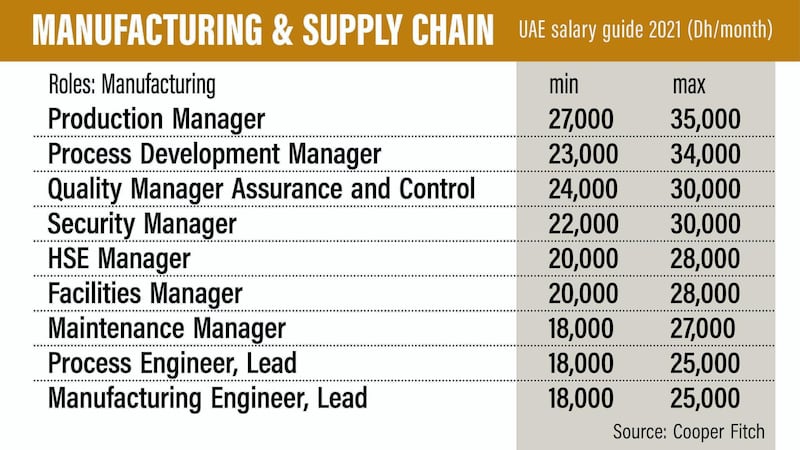

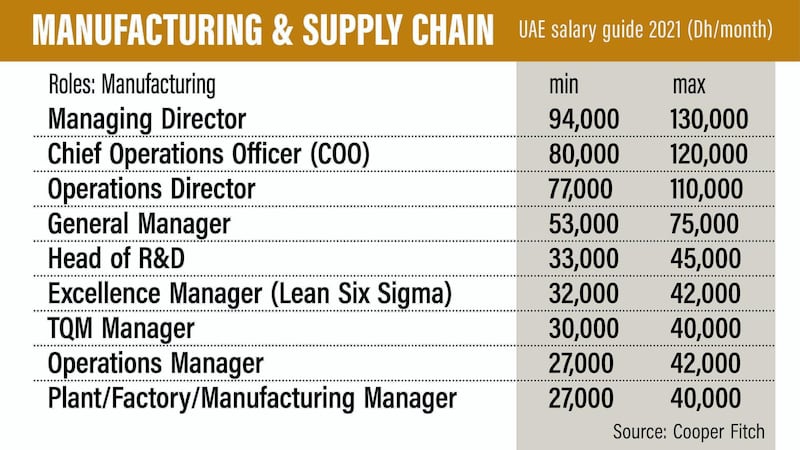

Manufacturing and supply chain

- Managing director (manufacturing): 95,000-130,000

- General manager (supply chain): 60,000-90,000

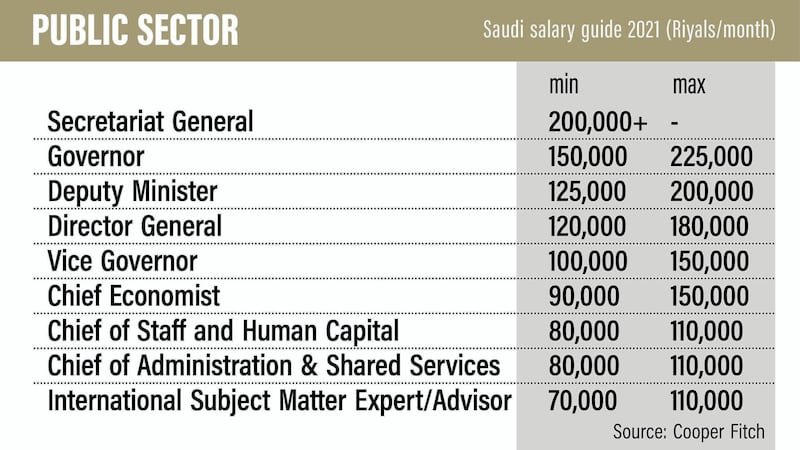

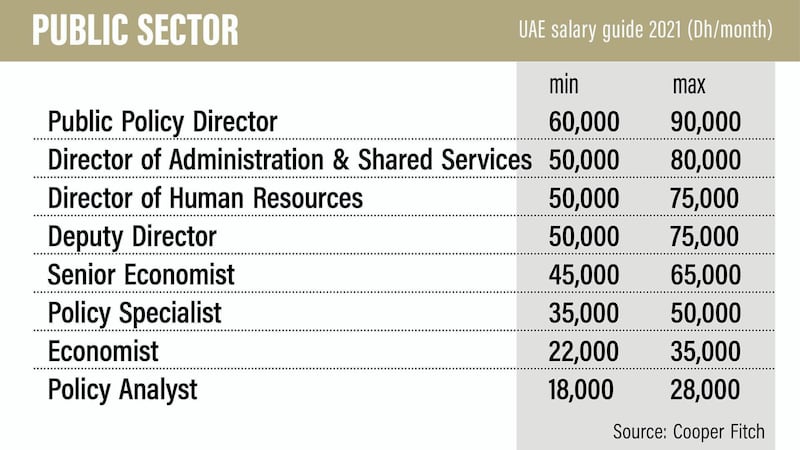

Public sector

- Secretariat general: 200,000+

- Governor: 150,000-225,000

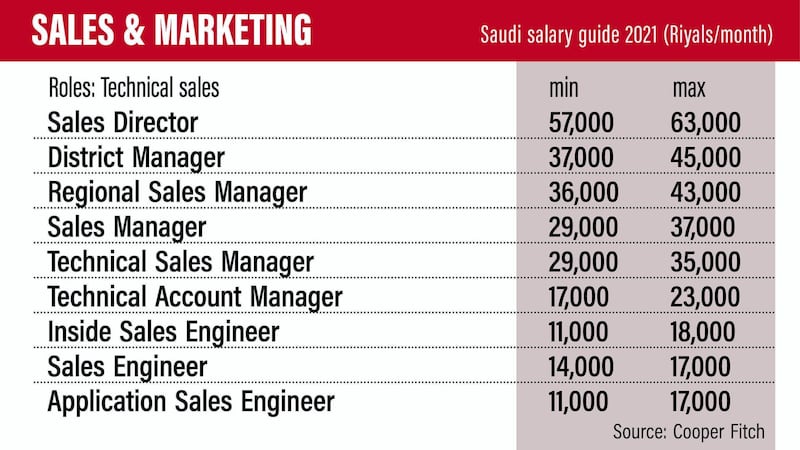

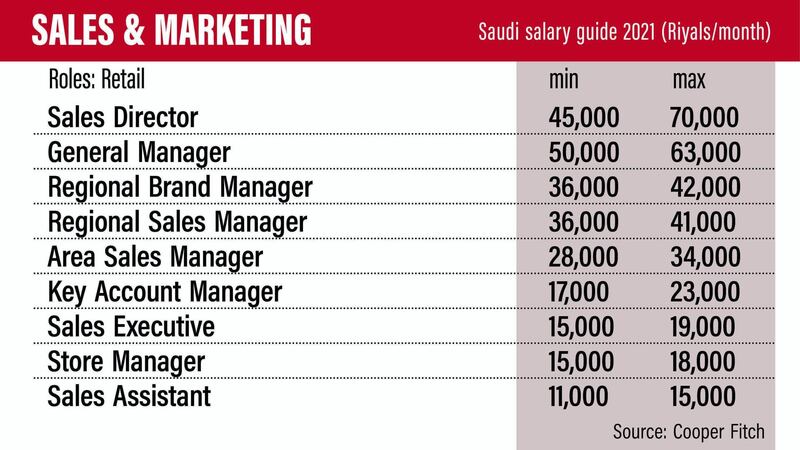

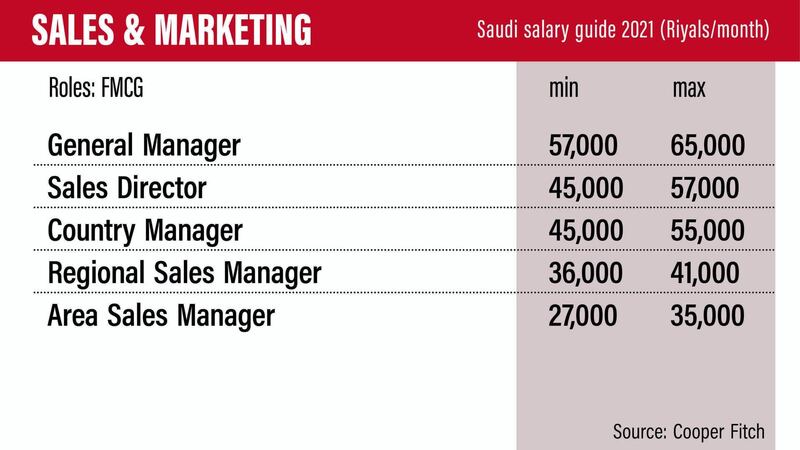

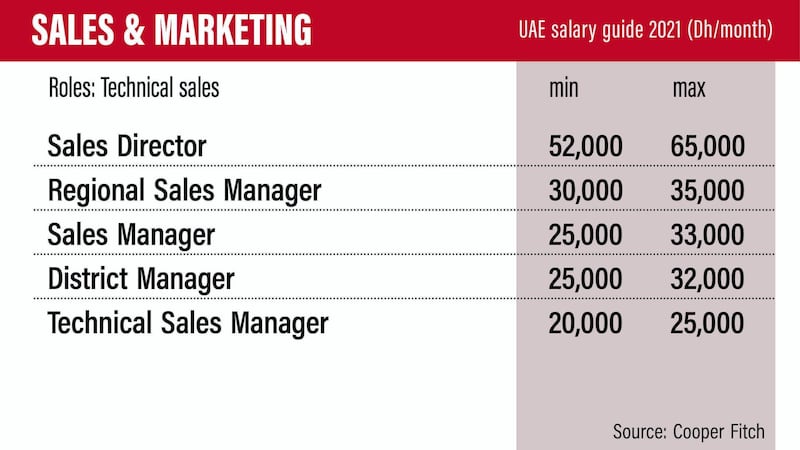

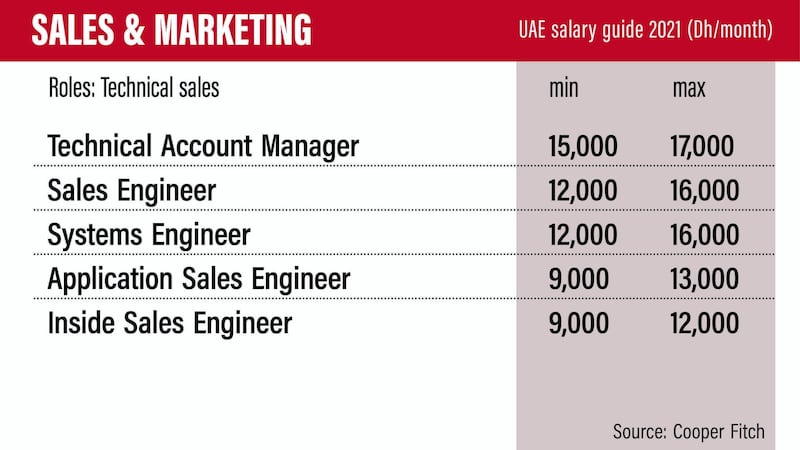

Sales and marketing

- Regional commercial director (healthcare): 61,000-70,000

- Sales director (retail): 45,000-70,000

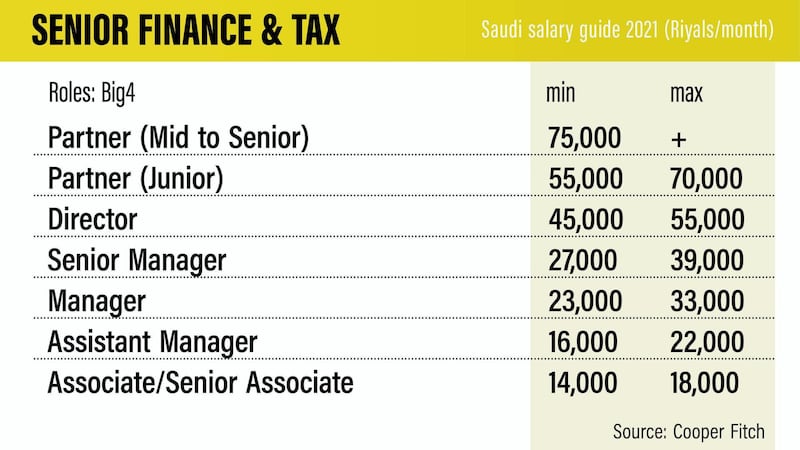

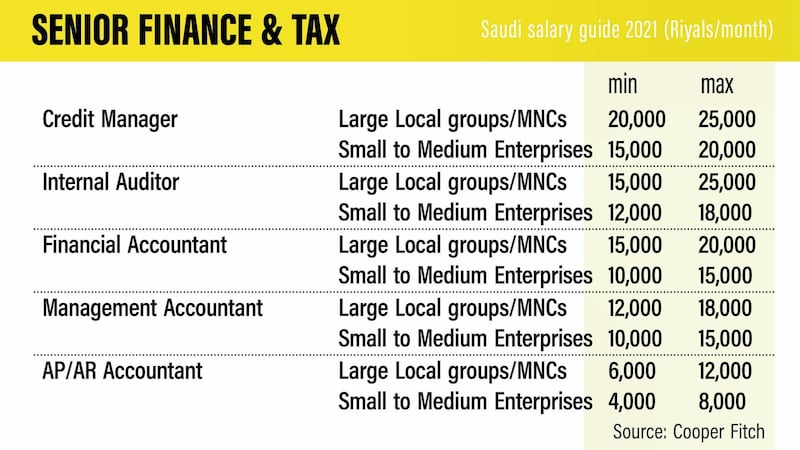

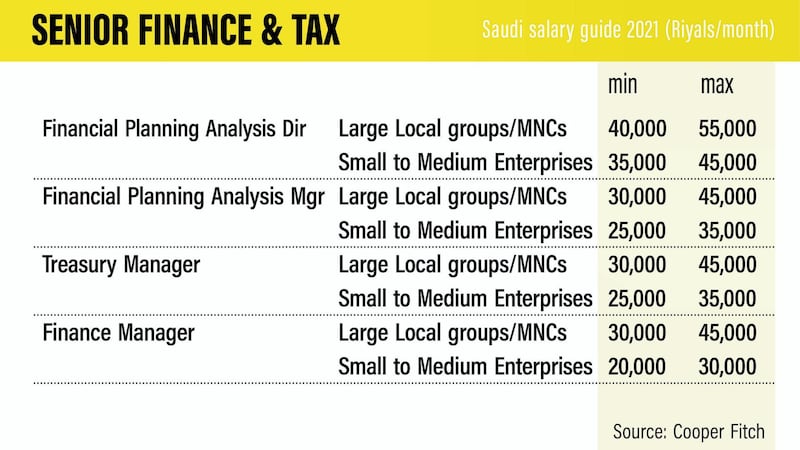

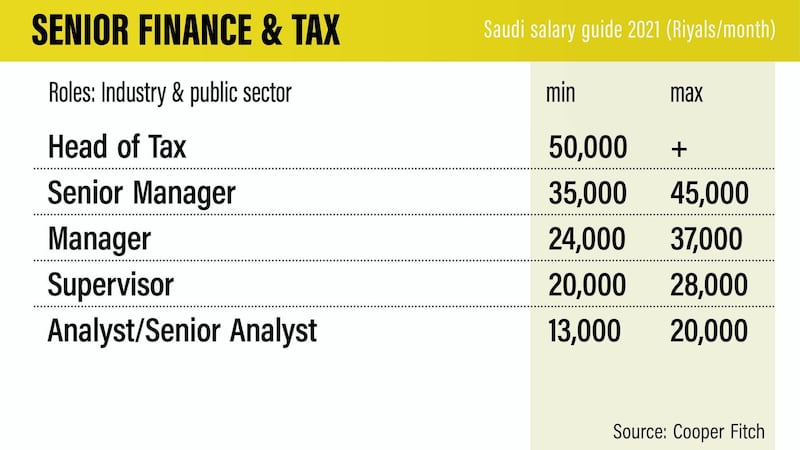

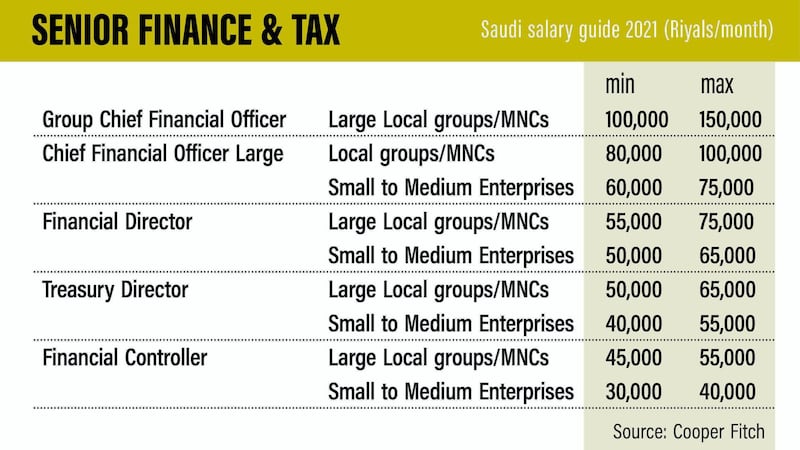

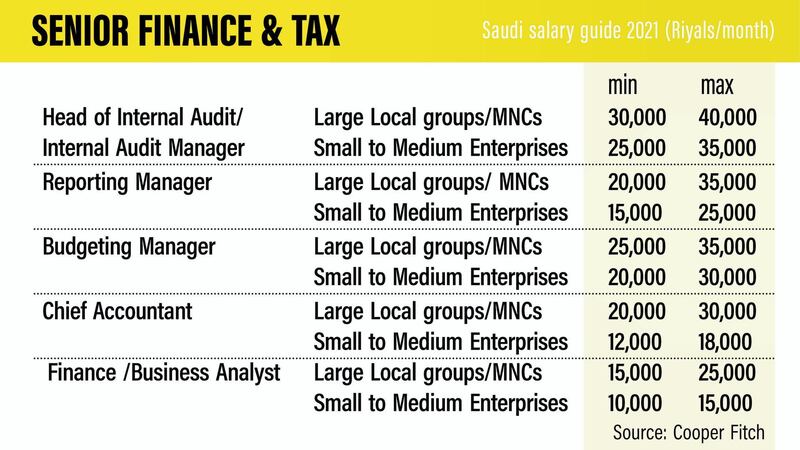

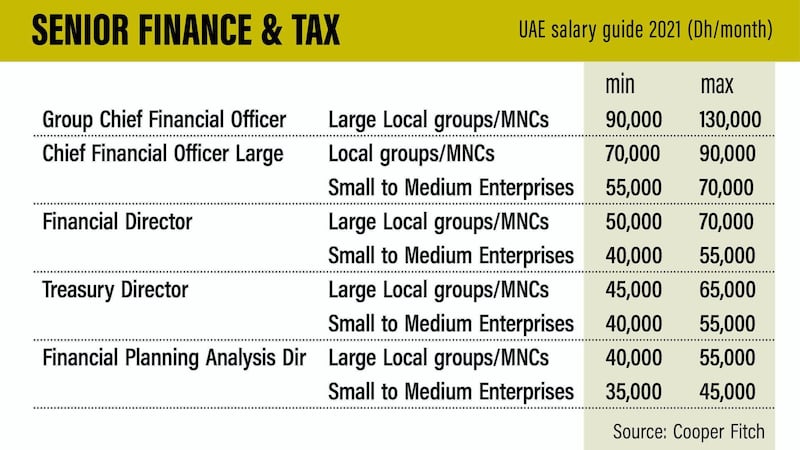

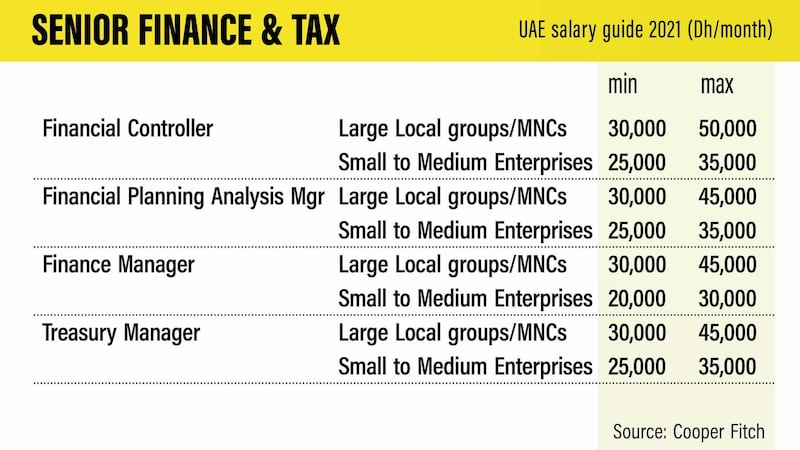

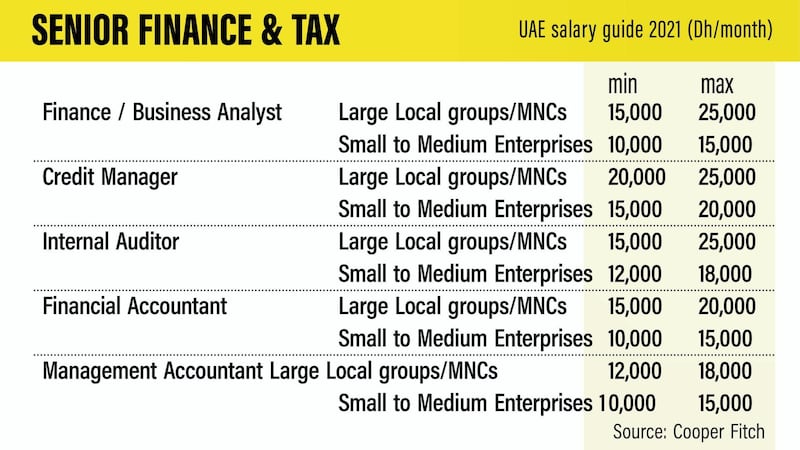

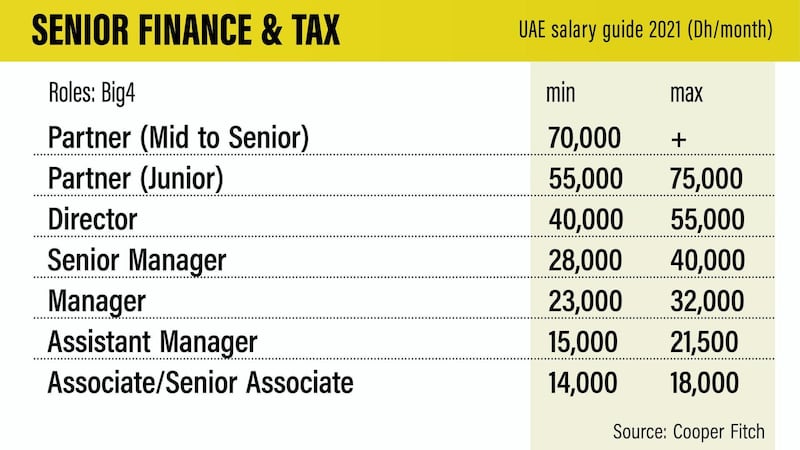

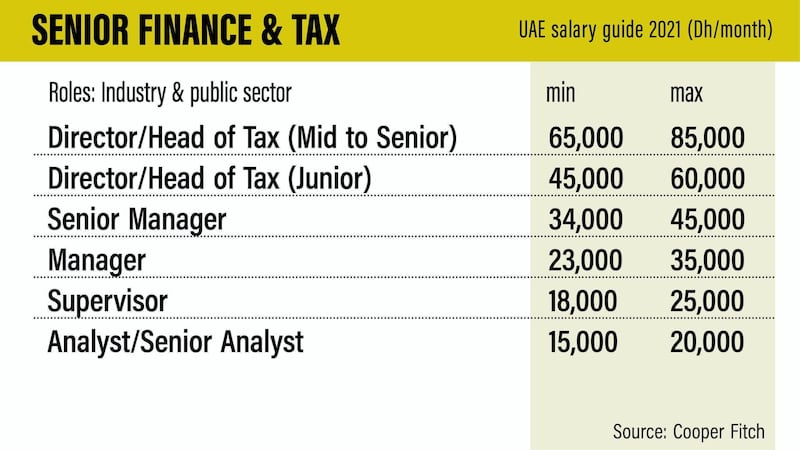

Senior finance and tax

- Group chief financial officer: 100,000-150,000

- Big4 partner (mid to senior): 75,000+

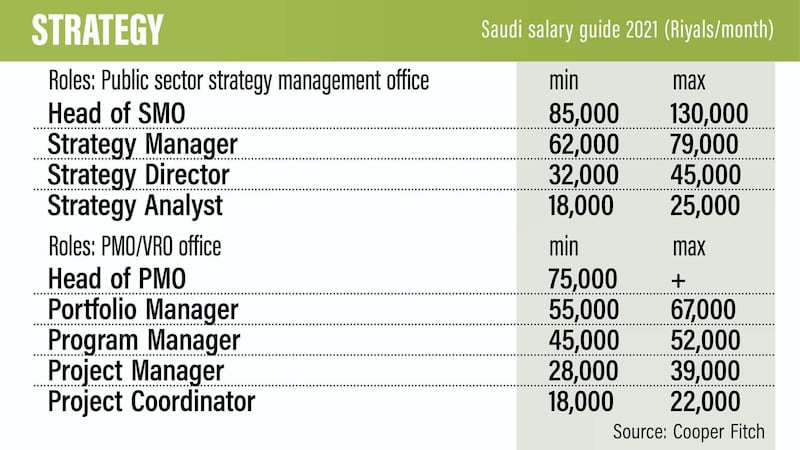

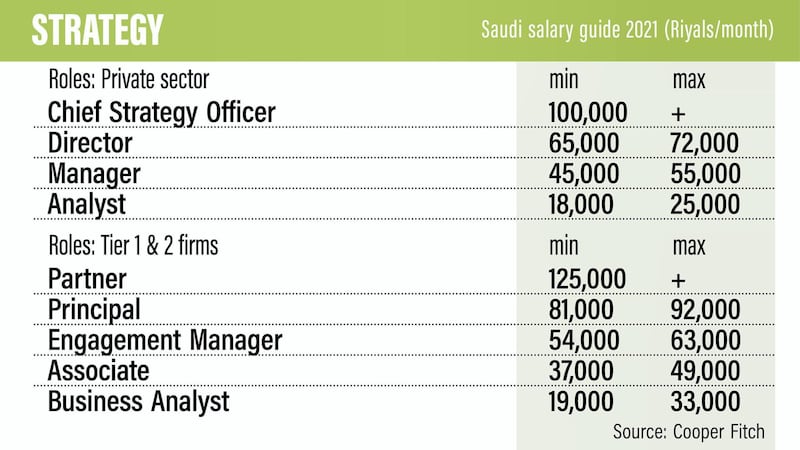

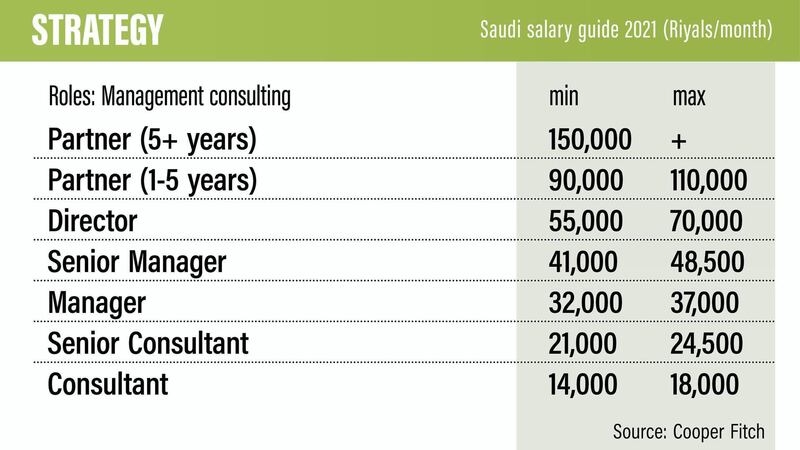

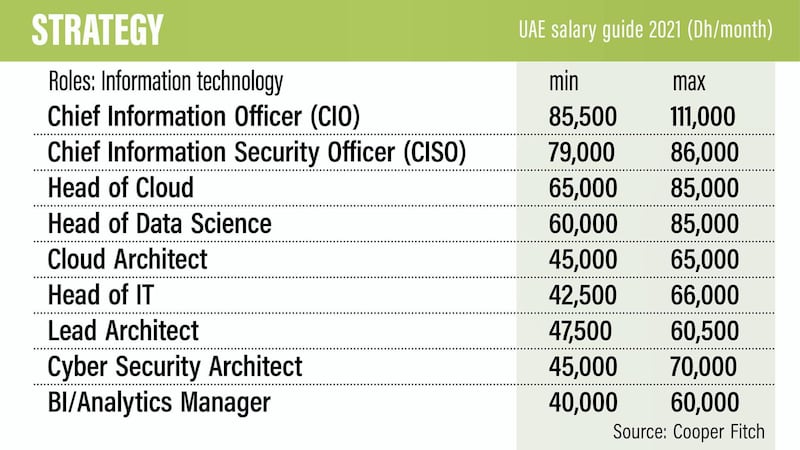

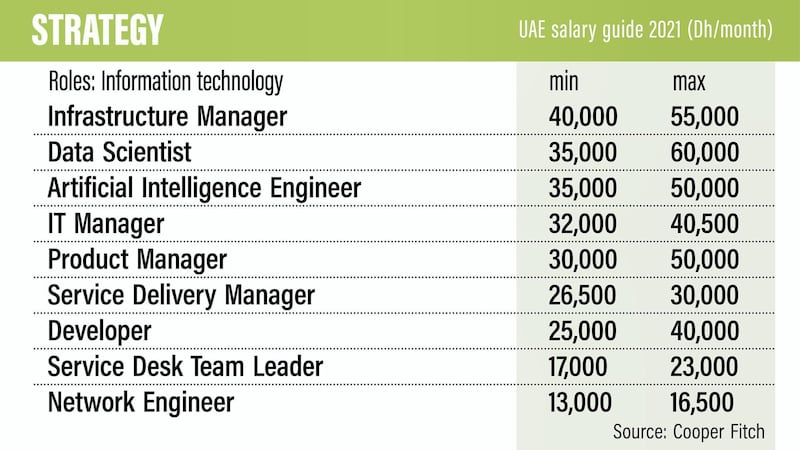

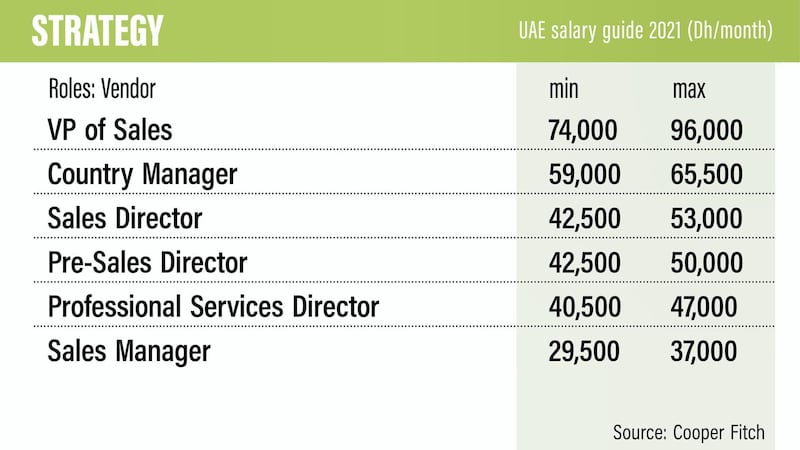

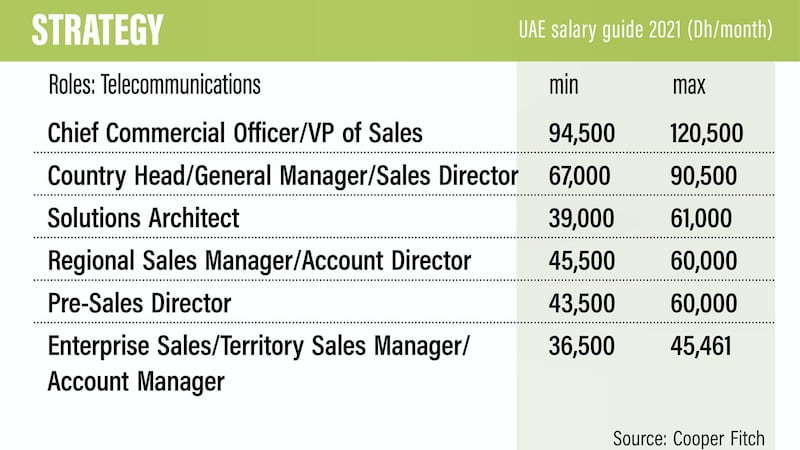

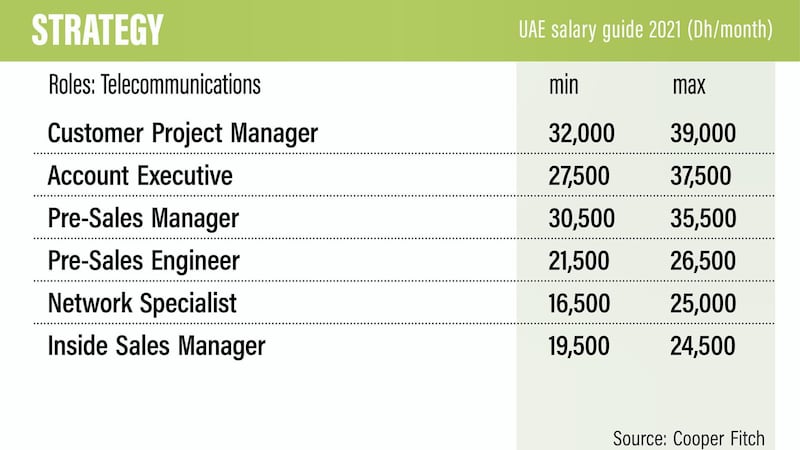

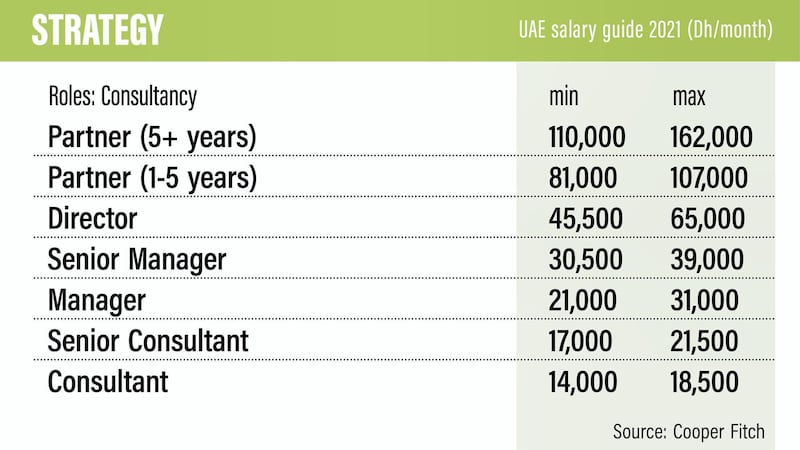

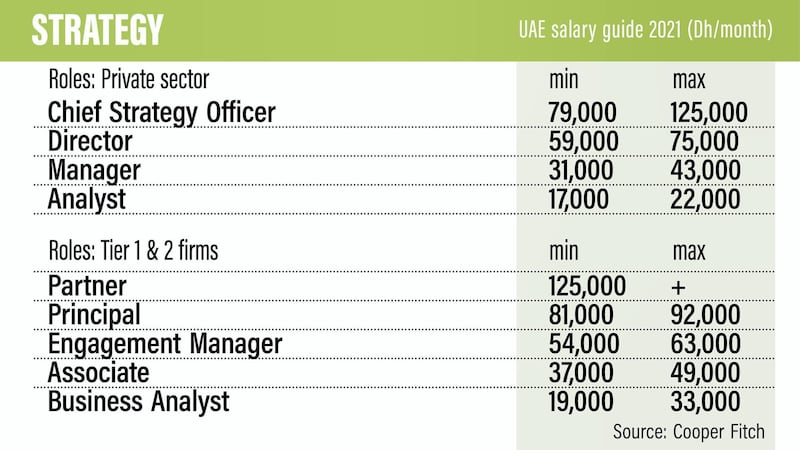

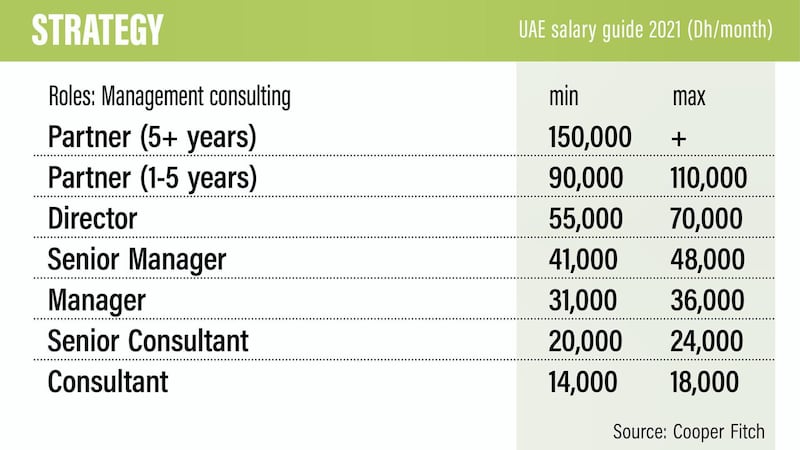

Strategy

- Partner (5+ years, management consulting): 150,000+

- Partner (tier 1 & 2 firms): 125,000+

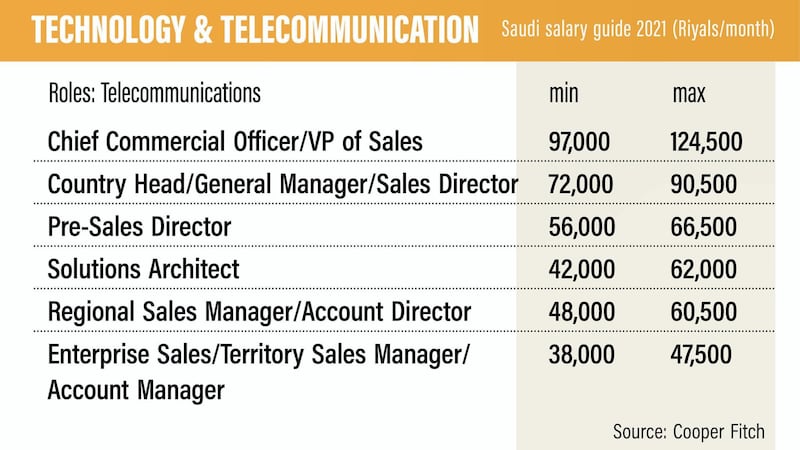

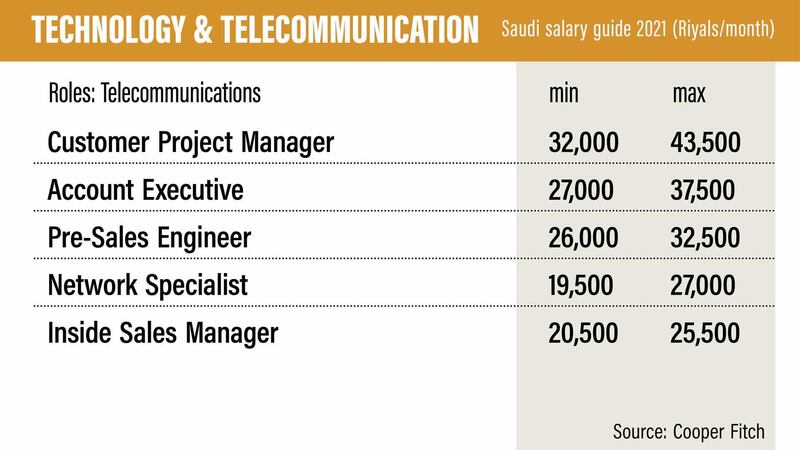

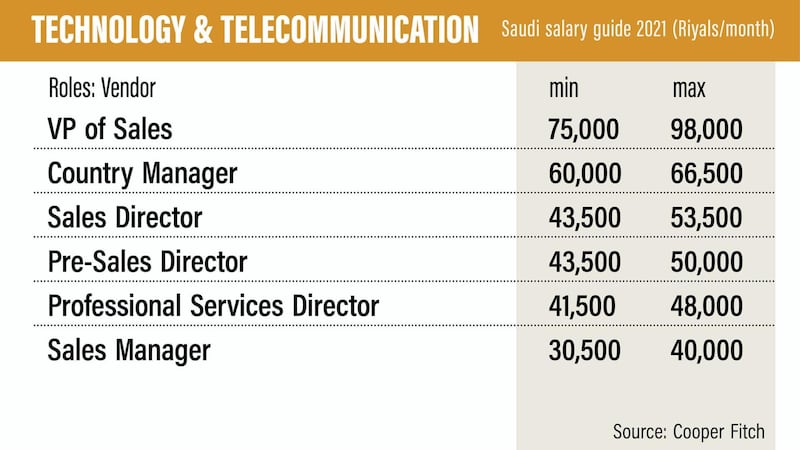

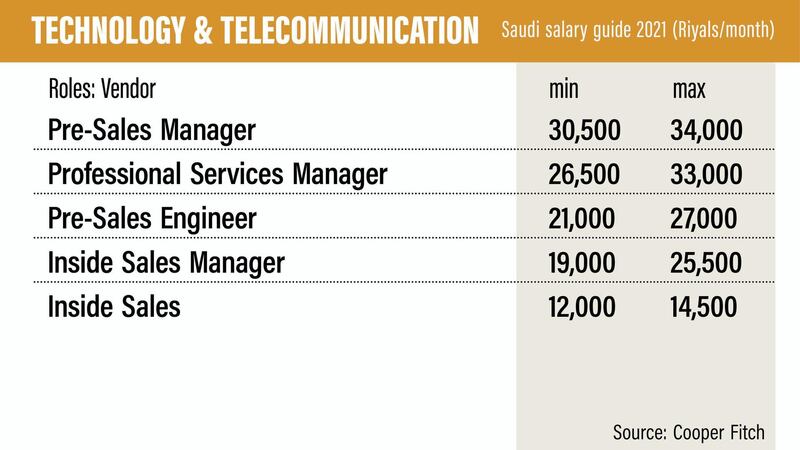

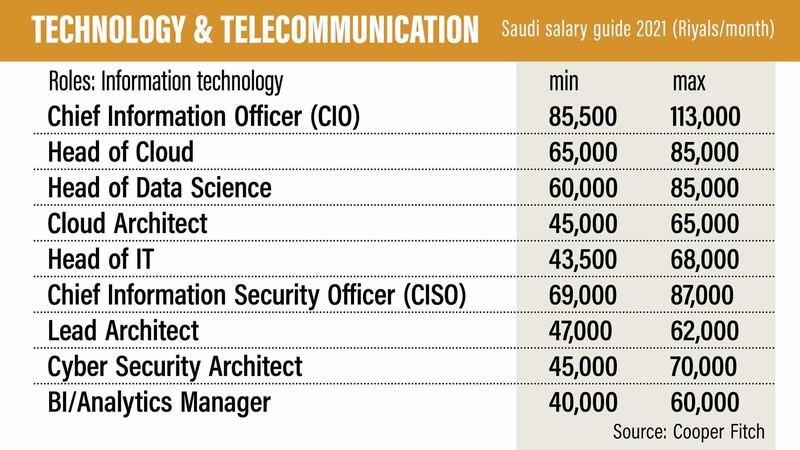

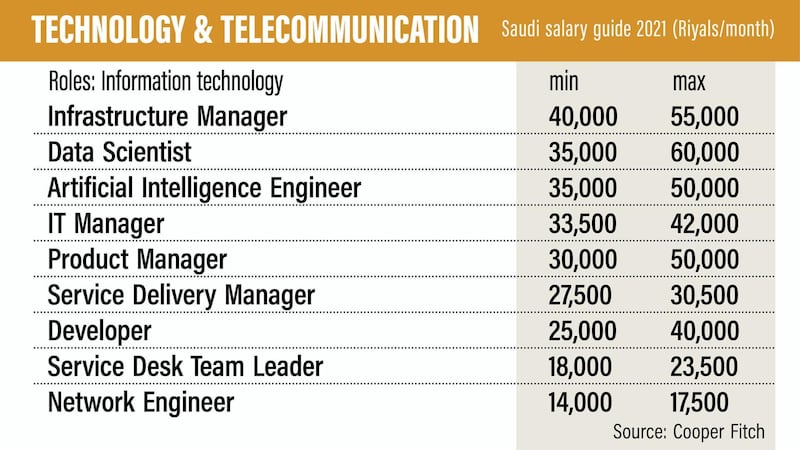

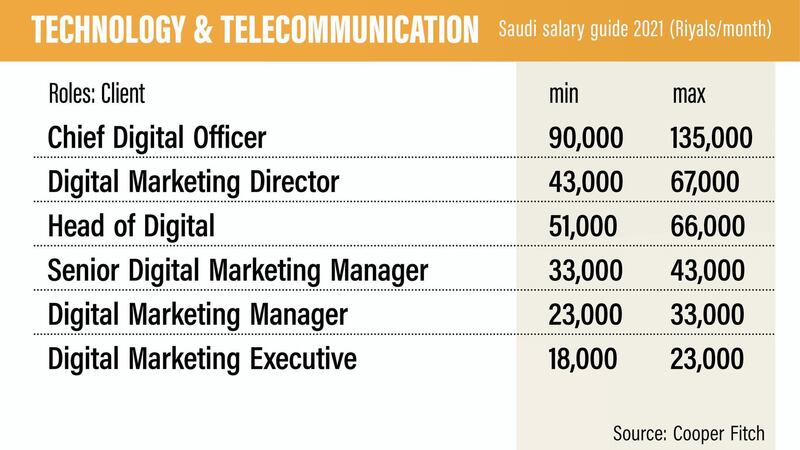

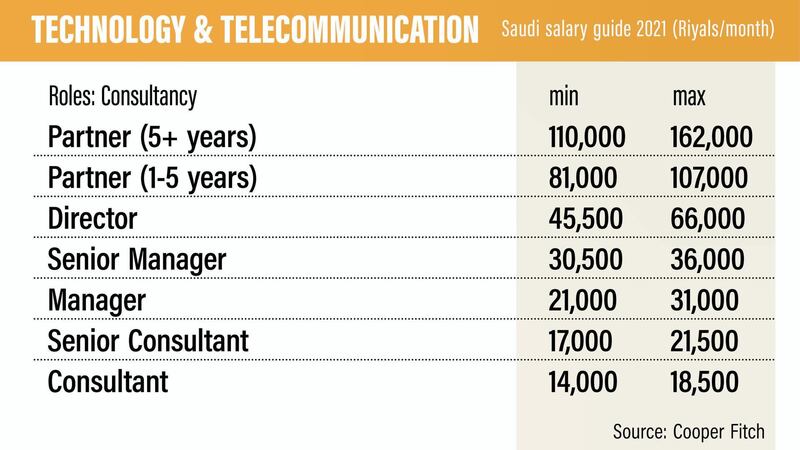

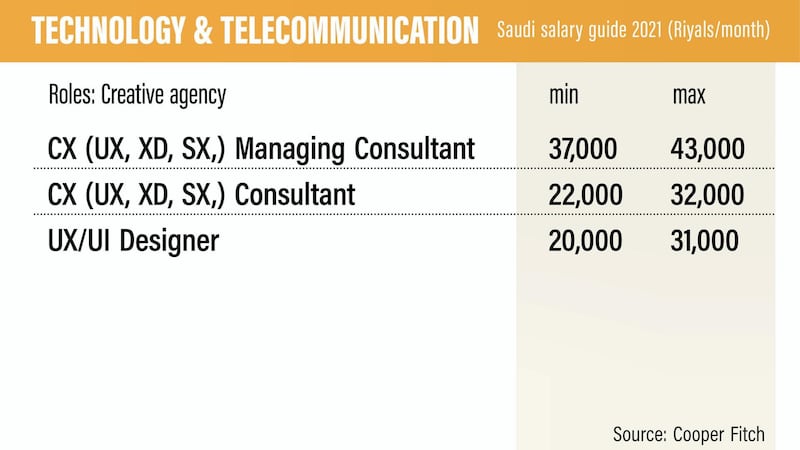

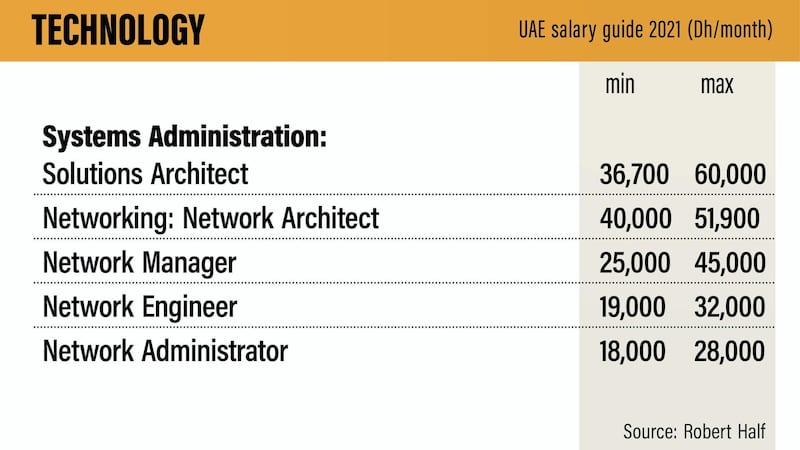

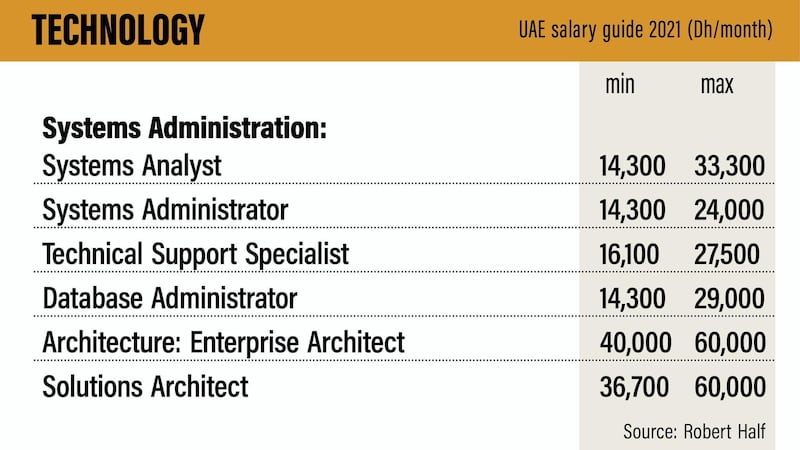

Technology and telecommunications

- Partner (5+ years consultancy): 110,000-162,000

- Chief digital officer: 90,000-135,000

Saudi economic outlook

The International Monetary Fund estimated in its most recent World Economic Outlook update that the Saudi economy contracted 3.9 per cent in 2020, but is set to grow 2.6 per cent in 2021 and 4 per cent in 2022.

This compares to an estimated 5.4 per cent fall in 2020 for Germany, 10 per cent for the United Kingdom and 5.1 per cent for Japan.

The Institute of International Finance said this week that the kingdom is poised for a "modest" recovery this year, led by the non-oil sector.

The impact of Covid-19 was limited due to a relatively young population and a "strong policy response" from the government. It unveiled 142 economic stimulus initiatives worth 214 billion riyals ($57bn) last year.

In the non-oil private sector, business activity continued to tick up in January, reaching its highest reading since November 2019, according to the IHS Markit Saudi Arabia Purchasing Managers' Index.

Despite strong growth in both output and new work, hiring remained subdued.

"While client demand has soared in recent months, this has not fed through into rising employment numbers," David Owen,an economist at IHS Markit, said, adding that firms have indicated that excess staff capacity was sufficient to deal with rising incoming work.

Saudi's PMI reading fell as low as 42.4 in March 2020 amid stringent measures to tackle the onset of the pandemic. A reading below 50 marks an economic contraction. It has, however, been above 50 since September.

What else is happening in Saudi which could impact the jobs market?

A "megacity of the future" called Neom is being built in the north west of the country.

It is the kingdom's flagship business and tourism development on the Red Sea coast amid plans to diversify the economy away from oil.

Other big projects include the huge Red Sea tourism scheme covering 90 offshore islands, the Qiddiya entertainment city near Riyadh and the $20bn Diriyah Gate and Al Ula heritage sites.

Meanwhile, earlier this month, Saudi announced that it will stop giving contracts to any company that has its regional headquarters outside of the country from 2024.

_______________